“To see what is in front of one’s nose needs a constant struggle.” ― George Orwell

“He who controls the past controls the future. He who controls the present controls the past.” ― George Orwell, "1984"

“But if thought corrupts language, language can also corrupt thought. A bad usage can spread by tradition and imitation even among people who should and do know better. — George Orwell, Politics and the English Language

When the people of the world have a common monetary language, completely freed from every government, it will so facilitate and stabilize exchange that peace and prosperity will ensue even without world government. A union of peoples rather than a union of political governments is what this world needs. — E.C. Riegel - The New Approach to Freedom p.28 (1976)

"People should think things out fresh and not just accept conventional terms and the conventional way of doing things." — R. Buckminster Fuller

“The process by which money is created is so simple that the mind is repelled.” — John Kenneth Galbraith, Money: Whence It Came, Where It Went (1975), ch.3 Banks p.18

Pardon the indulgence in so many foreword quotations. They serve to drive home a crucial, yet seldom acknowledged aspect of money — that for thousands of years, it has been a dominant psychological paradigm so illusory, so deceptive, so mesmerizing, that it restricts humanity's ability to perceive it and transcend it. Think about Galbraith's choice of words: "... the mind is repelled."

The dictionary informs us that repel means:

1. 'to drive away with force',

2. 'to be repulsive or distasteful'

3. (formally) 'to refuse to accept something, especially an argument or theory [or the truth].'

An exaggeration? The thesis of this essay is that it is not, and that we must overcome the very language that paralyzes our ability to formulate a correct conception of money and economics before we are ever to successfully formulate an economic system that serves—instead of enslaves—humanity.

Our thinking about money prohibits us from creating a sustainable economy. We have to psychoanalyze a collective state of denial—subconscious by definition—to expose and eradicate our blind spots, emotional responses, and irrational ideas about money, so that at last we can apply reason, logic, and the scientific method to economics. Only then will we be able to engineer a system based on actual natural law, free of opinions and socio-political agendas.

Human Nescience

The seriousness of the matter is expressed by Thomas Robertson, in Human Ecology The Science of Social Adjustment (p.43) :

"... owing to the technical nature of money creation it is ... the great source of centralized power, by which men's individual sovereignty is destroyed; but as men do not use their minds aright, the true nature of the money system is rarely perceived. The people cling with lamentable tenacity to their illusions about the system. They shut their minds to the facts and yet hope somehow to sweep away the evils which beset them; but until the financial system has been comprehended in its reality the present disorders will go on increasing until a total destruction of society has been encompassed."

and on p.119 :

"...in the space of 300 years, the money system has achieved what neither religion, nor culture, nor nationality, nor conquest has ever accomplished, and that is—complete world domination."

The IFLAS Money and Society course, for which this essay was written, indeed is an excellent introduction to the historical facts about money and the money system so that one can arrive at the truth that:

1) money is merely an accounting system,

2) the real functioning of economy is rarely penetrated, even by experts, due to widespread ignorance about the banking system,

3) there is a conspiracy to maintain this ignorance to the extent of deliberate propaganda and disinformation and

4) the money system primarily serves nefarious frauds and crimes against humanity, in the form of wars and of covert operations. It is used to manipulate and destroy entire countries. Disinformation and ignorance are necessary to cover up the activities of this criminal regime.

But there are certain illusions about money of which the course only scratches the surface: these are primary concepts, such as the definition of value, the illusion of pseudo-properties of money being a 'commodity' (a "store of value") that 'circulates' ("medium of exchange"). These basic notions are discussed as axiomatic and taken for granted, but hardly challenged, seriously investigated, and diligently analyzed.

These messages about illusion and delusion come to us in various contexts: psychology, religion, the absolute naked truth expressed in the decidable rigors of ontological philosophy, or the proofs of abstract logic or pure mathematics. These messengers—be they engineers, sociologists, educators, mathematicians and logicians—are trying to tell us that what we are really dealing with is a self-destructive mental illness—something on the order a serious drug addiction, involving dependence and self-deception.

It is really impossible to separate our concept of money and our form of social organization from identification with profound terms of mass-hypnosis, mass-delusion, mass-psychosis, even psychopathy. The facts will be dismissed as 'conspiracy theories' until we face the ugly truth: we are currently blind to seeing a revolutionary path forward in human evolution. We have to confront, understand, and overcome our cognitive biases. There is something about the phenomenon that looks like a 'psychic entrainment system' that everyone today would understand epitomizes "The Matrix."

The fear of confronting the reality behind what our language and culture reveal about our money system and its effects on human activity and ecology is comparable to the dread of waking up in a mental hospital in a straight-jacket and being informed that one is mentally ill: unable to take responsibility for one's own life, suffering impaired contact with reality.

It would be little consolation to be informed that one was a victim of a psychological experiment, or of psychological operations (PSYOP) – that one had been deliberately manipulated, indoctrinated, hypnotized, programmed and brainwashed. It is almost too horrible to face, and no one could be blamed for wishing it weren't so.

Spook Origins of the Modern Financial System

The disgust associated with this "PSYOP" aspect of the money system is a strong discouragement from looking deep into its origins. There is no shortage of factual documentation that the entire system—despite general ignorance thereof—was designed and orchestrated by Harry Dexter White, appointed to manage the secretive Exchange Stabilization Fund (ESF) as documented by Eric deCarbonnel in What I have been afraid to blog about: THE ESF AND ITS HISTORY (MarketSkeptics 6/3/2011).

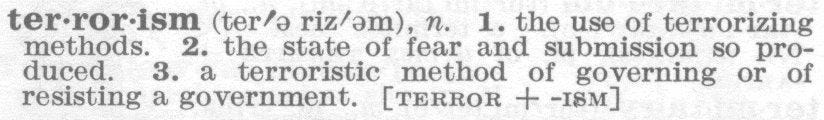

The ESF, IMF, World Bank, and many other organizations are creatures of the Office of Strategic Services (OSS) - later to become the CIA - the purpose of which are all to manipulate countries—ally and enemy—via money laundering, black operations, "economic hitman" operations, fomenting wars and provoking conflicts, counter-intelligence, "black" propaganda, disinformation, character assassination, blackmail, assassination, terrorism, drug and weapons trafficking.

The ESF also has had a shadowy relationship to the Bank of International Settlements (which also has nefarious origins)—since as late as the presidency of Ronald Reagan.

According to linguistics professor Noam Chomsky, the western world is under a regime of "total propaganda" the likes of which the world has never seen before. No study of the monetary system is complete without understanding the activities and operations of the ESF and its successors. It is therefore impossible to separate our language and conceptions of money, banking, and political-economy from the effects of propaganda and disinformation.

A few of many examples in our language of illusory concepts about money and its pathological effects:

"No money" signifies the shut door, a total impossibility, and in fact the absolute zero of action; and it cannot be too forcibly emphasized that this curtailment is the lot, not only of individuals, but of the most powerful nations on earth.

Our experience is rooted in the tangibility, value and scarcity of notes and coinage, which must be safeguarded or they may be irretrievably lost.

"Putting money in the bank.” This very expression indicates reality, tangibility, value, preciousness; and signifies confidence, trust, security.

The Financial System Facade

Stunning admissions from Graham F. Towers, former Governor of the Bank of Canada in the Canadian Government (1939) Enquiry report that give "conclusive evidence as to the real nature of the financial system" —a facade to the public:

The need for a gold reserve was largely psychological so far as domestic currency was concerned

Anything physically possible and desirable can be made financially possible

These are the issues that prevent a serious effort to creating a sustainable economy, which is by definition, a resource-based economy. The word economy means, simply, the management of resources; it has nothing to do with the large body of abstract theories that serve to obfuscate the subject.

Stripped of our illusions about what money is, we can then accept what it isn't. As president of the Minneapolis Federal Reserve (2009-2015), Narayana R. Kocherlakota concludes in his seminal work, Money is Memory:

Money itself is useless; monetary allocations are merely large interlocking networks of gifts.

Any technological advantages offered by money are also offered by memory... memory may technologically dominate money.

"Why does money exist?" Economists answer this by saying that money is a store of value, money is a medium of exchange, and/or money is a unit of account... the only thing that money adds to society is a (limited) ability to keep track of the past.

Money may only be an imperfect substitute for high quality information storage and access. This "real world" message serves to underscore that the government's monopoly on seignorage might be in some jeopardy...

With the understanding that money is nothing other than record-keeping (information), we become free to subject resource management to the scientific method, and specifically to the principles of systems engineering.

There are only a few "outsiders" who have dedicated themselves to understanding economics from a systems engineering perspective. Those, I confidently suggest, deserve further emphasis in any course or program aimed at developing a sustainable economic system—not merely another alternative money system. These authors should be studied thoroughly and their ideas should be developed and put to practical use:

Thomas Robertson

Robertson, whom I have already cited liberally in this essay, has given a great gift to humanity in his exposition of the "mental mechanism," how it functions, how it affects society, and what remedies are necessary. (Human Ecology: The Science of Social Adjustment [PDF])

Dewey B. Larson

Larson, author of The Road to Full Employment and The Road to Permanent Prosperity, is perhaps one of the finest minds the twentieth century has given. His penetrating reasoning ability and rigorous application of precise definitions offer the possibility of treating economics as an actual science—subject to natural laws as much as any physical science—instead of a religion or pseudoscience, mere opinions, conjectures and superstitions.

Following are some important conclusions that can form the basis of a scientific glossary of economics :

Production and consumption are the indispensable features of economic life

Production of goods is the only method of creating purchasing power

Purchasing power corresponds to energy

Law of Conservation of Purchasing Power (Purchasing power cannot be created out of nothing; Purchasing power cannot be dissolved back into nothing)

Payment for goods must be made in other goods

The economic measurement of goods must also be made in terms of goods

Values vary between different times and locations

Goods have two values : as purchasing power, and as consumption goods

Marc Gauvin

Gauvin approaches the subject of money and economy from the perspective of Information science, Linear time-invariant (LTI) system theory, decidable semantic ontology, and formal logic. His contributions include:

Bank of England's admission that money is defined "as an IOU and a unit of account" (only)

A Legal Approach To Cancelling All Current Money Contracts (which are legally undefined and invalid)

These have important philosophical and practical implications concerning:

The proper understanding of a stable unit of value in determining true economic costs (passive money)

The fact that, as information, money is an output and not an input to value creation

The fact that money does not circulate

The absurdity of austerity as experienced in the Greek debt crisis

Passive money systems cannot compete with non passive systems for a common resource base. The latter will starve the former.

Money as a scarce token destroys money's essential function as a record of value

Cryptocurrency

If X coin does not use PoW, then how would a cryptocurrency have value?

Concerning value represented in cryptocurrency, consider what actually occurs when "proof of burn" is used to convert one cryptocurrency unit to another. It's 100% psychological. The same is true of Proof of Work (proof of wasted energy).

Conclusion

I have shown that creating a truly sustainable resource-based economy does not require new legal or social structures or another iteration of money as a scarce token. Money, is in fact, nothing other than a receipt for a gift—BUT... we are being told that there is a 'shortage' of receipts!

All that is necessary for human ecology is the cleansing of the mind of primitive notions of commodity money or fiat money. Only then can we finally begin to put to practice the vision of futurist Jacque Fresco: intelligently governing our allocation and use of natural resources and human production so that the minimum needs of all people are met and removing artificial scarcity as the cause of war and crime, merely by means of information management science at the omnilocal level.

Afterword

I think that my conclusions that money is a psychological virus, drawn from the work of others much smarter than I, is aptly demonstrated by the response to this essay on the part of the professor and tutor of the IFLAS Money and Society MOOC : Absolutely nothing. Silence. When I submitted this essay, it was not popular. It received no comments. It was not even evaluated. That is precisely the point.

I do not accuse them of participating in a conspiracy of silence; I simply observe that, while the 'influentials' are undoubtedly earnestly searching for a solution or for people who can create one, they have not sufficiently transcended their programming, making them unwitting intellectual gatekeeper-shepherds. When presented with answers they had never thought to question, the end result is a paralyzing cognitive dissonance.

Addendum

Since I wrote this in 2014, it has been migrated (painstakingly) from one ill-fated platform to another several times.

In 2022 I have only updated broken links, created new archives on archive.is and archive.org (the latter, being dependent on ‘philanthropy,’ is not to be trusted for retaining documents that offend the Powers That Be), recovered lost PDF documents, and implemented keyword search links to videos that are likely to disappear from YouTube. Such is the memory hole reality we currently live in.

At the time of this update, I now wish I had said more about the topic of cryptocurrencies, but at the time the crypto space was not ready to hear outlandish opinions about elastic money supply (the opposite of any deflationary cryptocurrency), or the absurdity of the need to buy money before there can be money, or the plain fact that as more “deflationary” cryptocurrencies are launched, this is, in fact, inflationary.

As we are today on the cusp of being coerced into accepting Central Bank Digital Currencies (CBDCs), I’ll have more to say on this topic. It’s necessary, because more people are confused on this topic than ever.

Additionally, many thanks to the illusrtrious Patrick Gunnels, for his impeccable reading and appreciation of this essay, March 2022 on Reading Epic Threads.

http://bibocurrency.com/index.php/downloads-2/19-english-root/learn/305-they-way-it-could-be

http://bibocurrency.com/index.php/downloads-2/19-english-root/learn/206-money-vs-credit